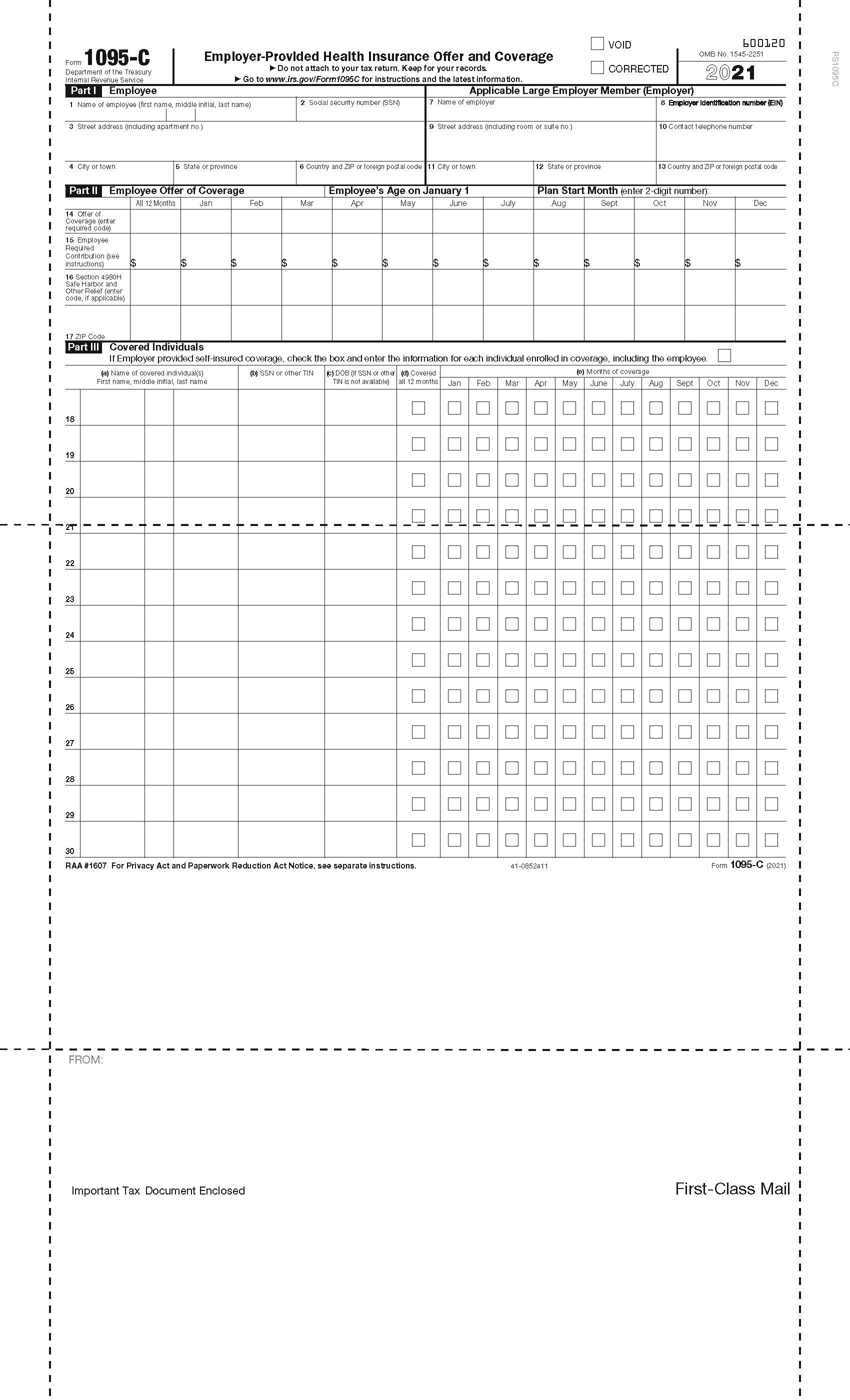

1095c instructions 19 ; · On October 2, , the IRS published Notice 76 , announcing an automatic 30day extension of the deadline to distribute Form 1095Cs toForm 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Patt Il, includes information about the

Employer Aca Reporting Final Forms Lawley Insurance

Form 1095-c (2020) instructions for recipient

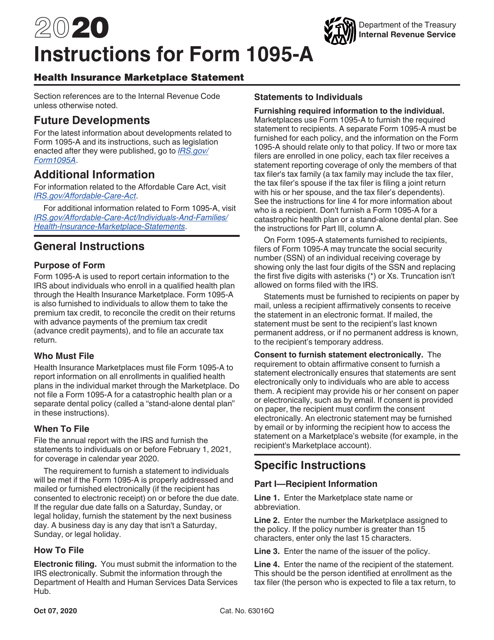

Form 1095-c (2020) instructions for recipient- · Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last year Minor Changes to Form 1095CInstructions for Form 1095A () Health Insurance Marketplace Statement Section references are to the Internal Revenue Code unless otherwise noted Instructions for Form 1095A Main Contents Future Developments For the latest information about developments related to Form 1095A and its instructions, such as legislation enacted after they were published, go to IRSgov

Draft Irs Reporting Forms Released

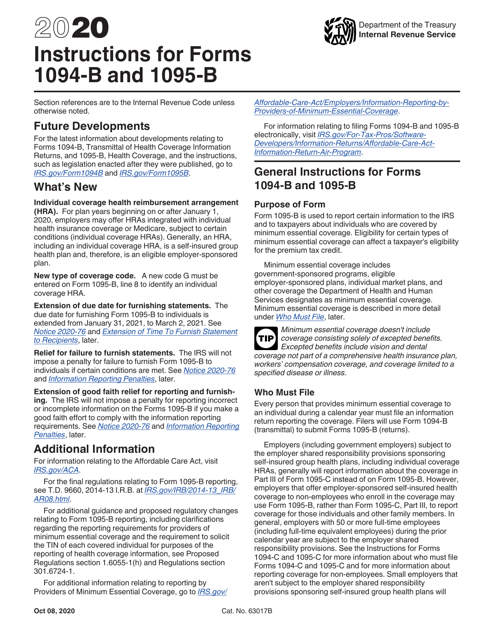

/08/ · While reporting this information, employers must be clear about the Codes to be entered on ACA Form 1095C Previously, we've reviewed the INS and outs of ACA form 1095C For the tax year , IRS has anticipated new codes These codes will pertain to the individual coverage health reimbursement arrangement (HRA) According to HRgov, the HRA is "a specificUpdated on January , 21 1030am by, TaxBandits For the calendar year , the IRS has updated Form 1095C with few changes It includes the introduction of new codes and lines for reporting Individual Coverage HRAsKeep in mind that this new form should be used only forSeparately for each type of form (ie, separately for Form 1095B and 1095C) and for original and corrected returns Finally, the IRS announced in Notice 76 that this will be the final year employers can rely on penalty relief for

No M Form 1095C () Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, · The Form 1095C instructions note that the Code § 4980H(b) affordability threshold for plan years beginning in is 978% (see our Checkpoint article) Both sets of instructions indicate indexed penalty increases for reporting failures from $270 to $280 per return, with calendaryear maximum penalties increasing from $3,339,000 to $3,392,000 Due dates haveThe latest version of the form was released by the IRS in with all previous editions obsolete A fillable 1095B form is available for download below The Form 1095B due date is the last day of February if you file it on paper and the last day of March if you file it electronically the year that follows the calendar year of coverage

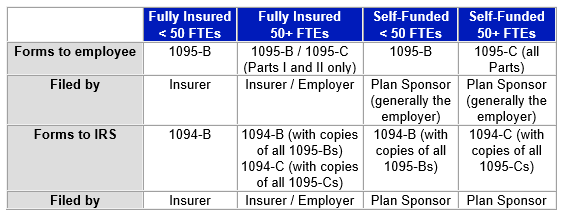

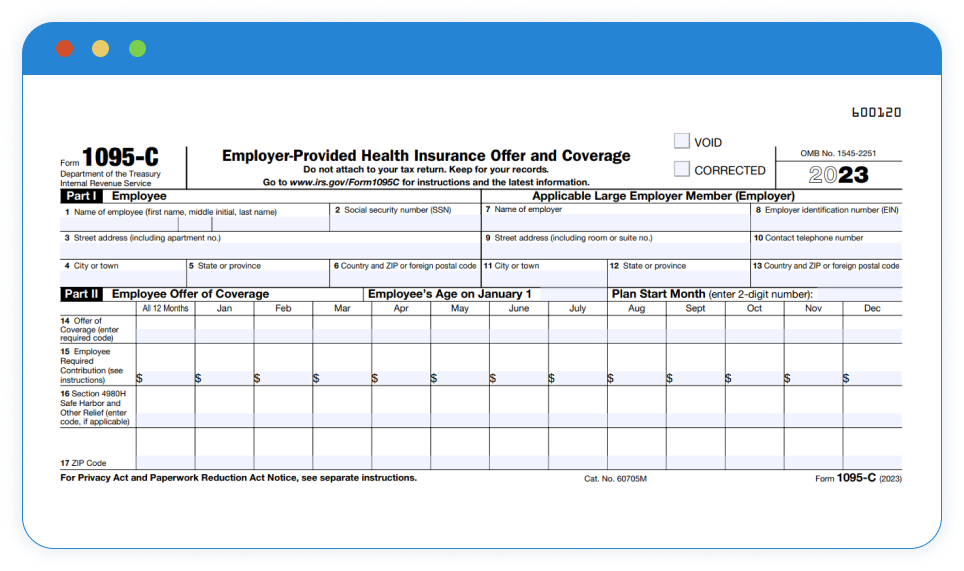

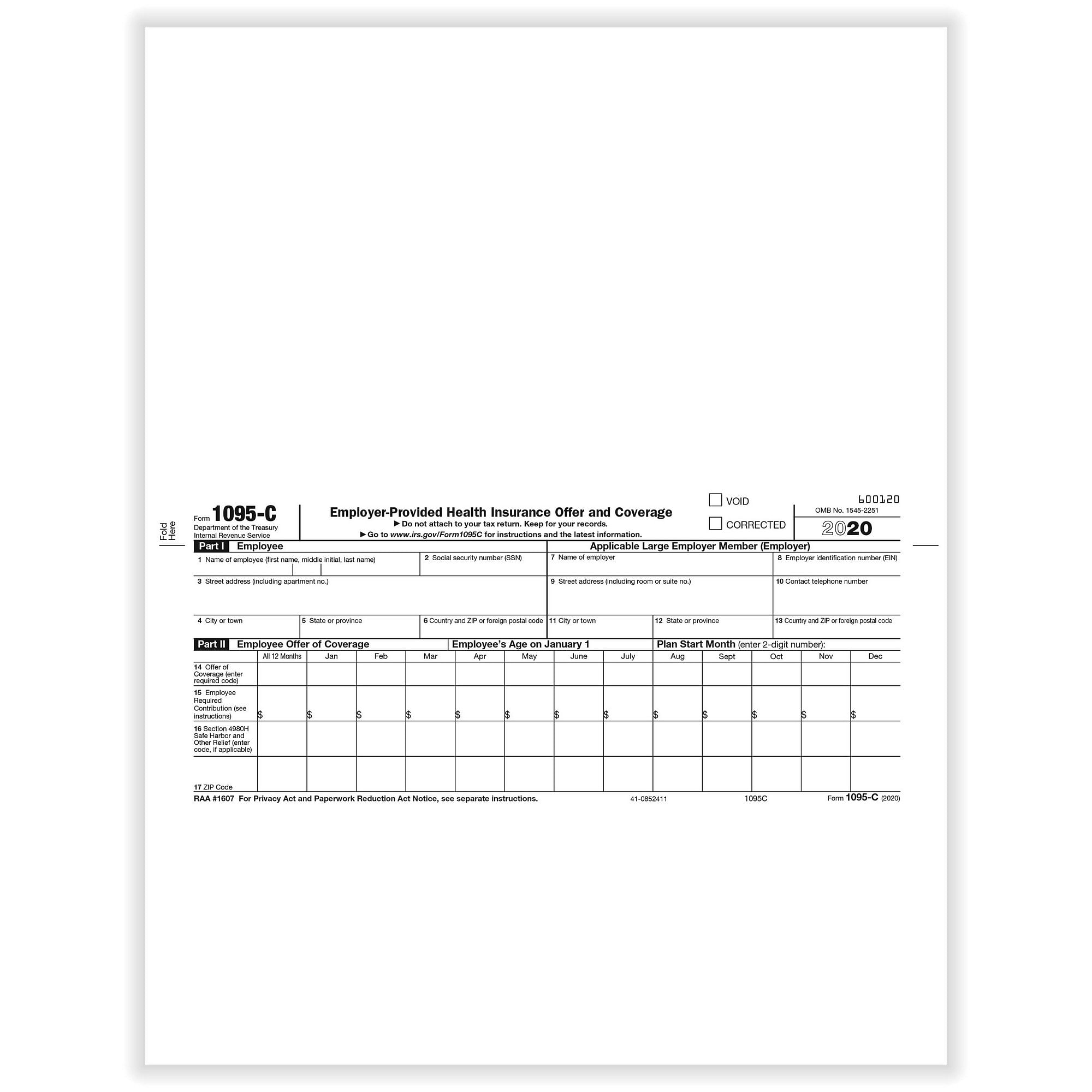

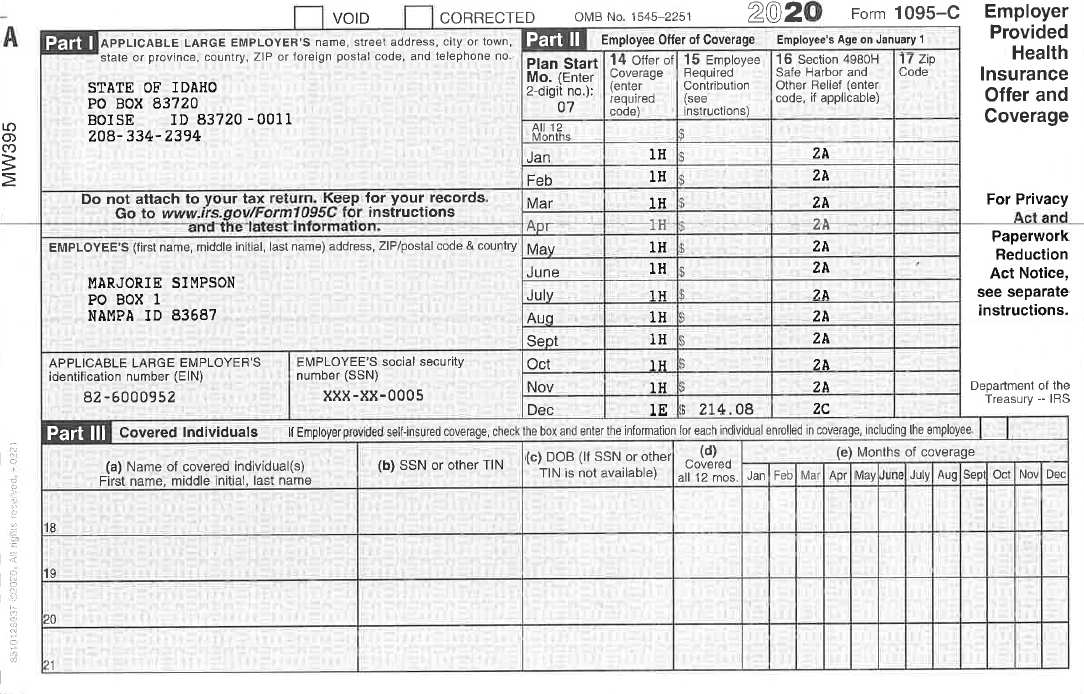

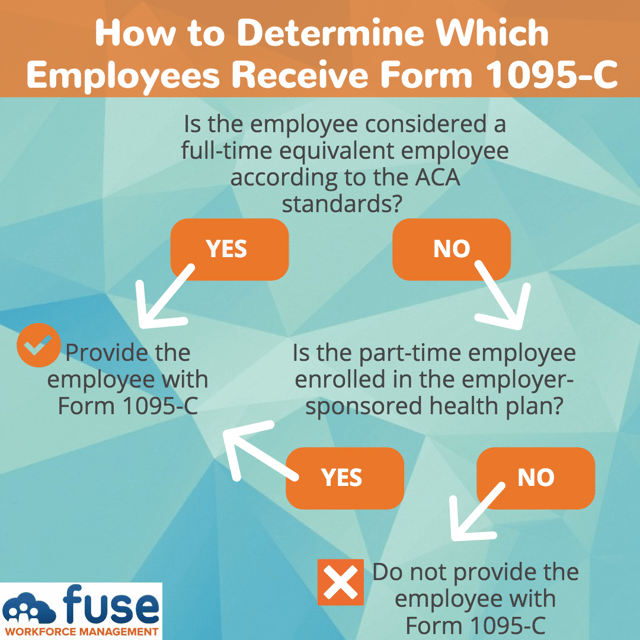

Applicable Large Employers hiring over 50 employees have to use 1095 C Form This document should contain information for employerprovided Health Insurance Offer and · Generally speaking, you may need a 1095 form to fill out your Form 1040, US Individual Income Tax Return, your Premium Tax Credit form 62, your Form 65, Health Coverage Exemptions, and to fill out the worksheet for figuring out your Shared Responsibility Payment on the Form 65, Health Coverage Exemptions Instructions in years it is applicableIf you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxAct return (Online or Desktop), click Federal On smaller devices, click in the upper lefthand corner, then click

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Form 1095 C Guide For Employees Contact Us

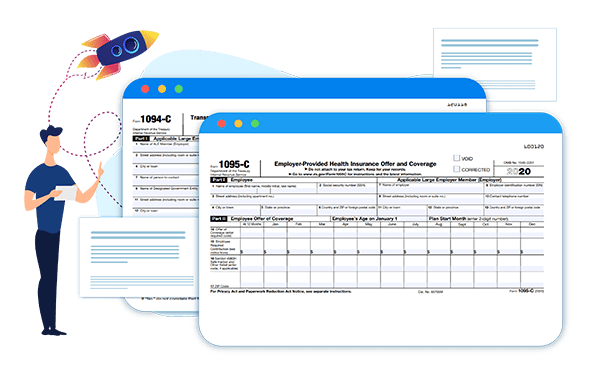

· IRS Releases New Drafts for Forms 1094C and 1095C Posted on August 13, 21 Form 1095C Instructions An article published by SHRM indicated that no changes were made to Form 1094C from 19 but significant updates were made to the 1095C draft These include eight new codes—1L through 1S—that address a recently introduced type of HRA knownThere are specific changes to the Form 1095C to reflect the reporting of ICHRAs First, there is an entirely new line that captures the employee's zip code, Line 17 This line indicates the zip code of the employee · The IRS has been actively enforcing the Form 1094C and 1095C reporting requirements against ALEs by assessing reporting penalties, which are generally $280 per reporting failure for forms required to be filed in 21 for the calendar year Thus, it is imperative that ALEs ensure they have a solution in place to accurately and timely complete these reporting

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

· September 23, 0511 Line 16 on the 1095C is for the Applicable Section 4980H Safe Harbor It is in the best interest of the employer to enter a valid code in line 16, if applicable, to minimize any contact from the IRS Enter the appropriate code in the All 12 Months box if the same code applies to the entire calendar yearForm 1095C () Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part II, includesWhile you will not need to include your 1095C with your tax return, or send it to the IRS, you may use information from your 1095C to help complete your tax return The Affordable Care Act requires certain employers to send Form 1095C to fulltime employees and their dependents This form contains detailed information about your health care coverage If you received an Advance

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Bim Group

Irs Form 1095 C Fauquier County Va

August 07, 10 Line 16 on the 1095C is for the Applicable Section 4980H Safe Harbor It is in the best interest of the employer to enter a valid code in line 16, if applicable, to minimize any contact from the IRS Enter the appropriate code in the All 12 Months box if the same code applies to the entire calendarIRS 1095C Form (EmployerProvided Coverage Insurance) 21 Get Form form1095ccom is not affiliated with IRS form1095ccom is not affiliated with IRS What Is irs govform1095a?Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, and Form 1095C

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

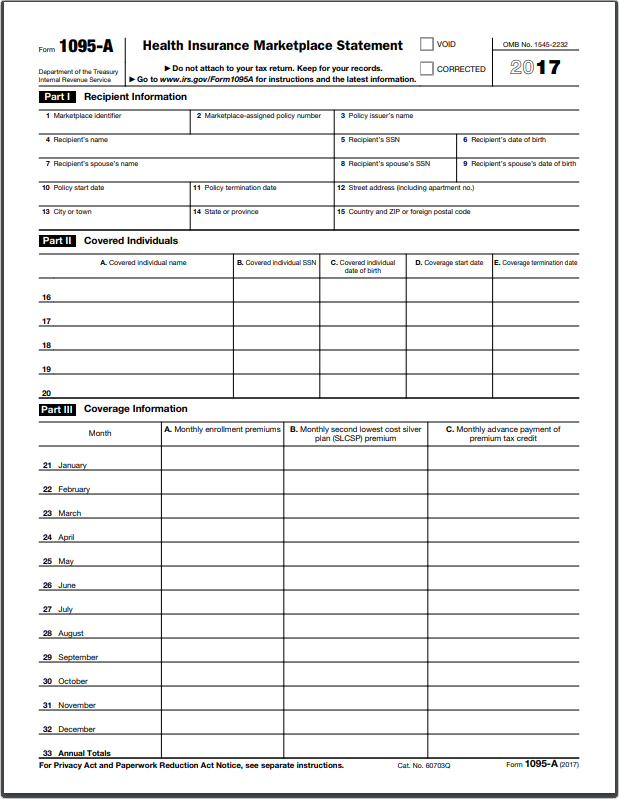

Product Number Title Revision Date;A separate Form 1095A must be furnished for each policy, and the information on the Form 1095A should relate only to that policy If two or more tax filers are enrolled in one policy, each tax filer receives a statement reporting coverage of only the members of thatInst 1094C and 1095C Instructions for Forms 1094C and 1095C Inst 1094C and 1095C Instructions for Forms 1094C and 1095C

Microsoft Dynamics Gp Year End Update Affordable Care Act Aca Microsoft Dynamics Gp Community

Irs Issues Draft Form 1095 C For Aca Reporting In 21

ACA Agency Instructions for 1095C File Review Page 6 of 16 Review Employee Offer of Coverage Part II Agency File Columns AA ‐ AN Form 1095‐C Part II – Employee Offer of Coverage (Offer of Coverage) Columns AA For Calendar Year , this two digit field is required For state employees the plan start month is 01 For · Quick Facts The IRS recently released final Forms 1094C and 1095C and Instructions for Forms 1094C and 1095C (Instructions) The IRS also released final Forms 1094B and 1095B and related instructions The forms largely mirror the 19 versions, but they include a few substantive changes · IRS Releases Instructions for Forms 1094C and 1095C with Most Substantial Changes in Years October 19, On October 14, the IRS finally released its draft instructions for the Forms 1094C and 1095C Confusingly, the IRS appears to have released the final instructions the next day

Aca Reporting Requirements Aca Compliance Aps Payroll

Updates To Form 1095 C For Filing In 21 Youtube

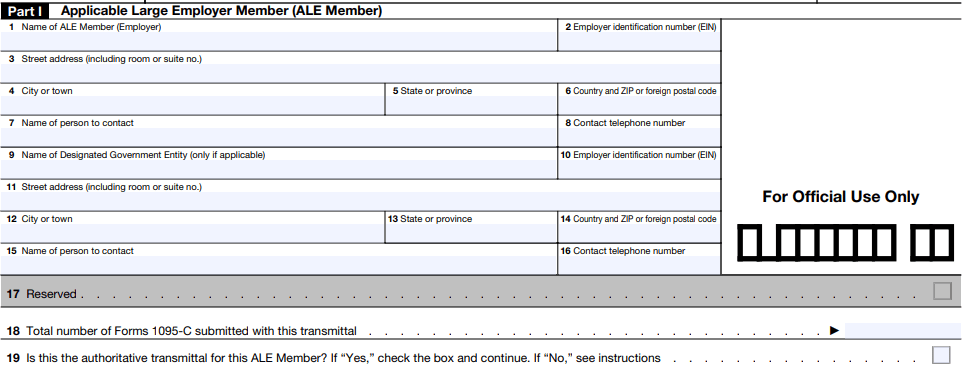

· Page 2 FTB Pub 35C (NEW ) California Instructions for Filing Federal Forms 1094C and 1095C References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 15, and to the California Revenue and Taxation Code (R&TC) What's NewThe other Form 1094C should not be identified as the Authoritative Transmittal on line 19, and should report on line 18 only the number of Forms 1095C that are attached to that Form 1094C, and should leave the remaining sections of the form blank, as indicated in the instructionsForm 1095C What is Form 1095C?

Changes In Irs Form 1095 C For Taxbandits Youtube

Irs Releases Draft 19 Forms 1094 And 1095 And Related Instructions

The instructions include a number of changes and clarifications related to reporting o The Form 1095 C also includes a new section to enter the zip code used to determine affordability for an ICHRA, if one was offered to the employee In addition, Part II of the Form 1095 C includes a new section to enter the employee's age on Jan 1 Additional ResourcesIRS Form 1095C Filing Instructions for 21 Updated November 05, 800 AM by Admin, ACAwise Every year, ALEs (Employers with 50 employees) must report to the IRS about their offered health coverage information to the employees The information is to be reported through Form 1095C under section 6056When the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

Draft Irs Reporting Forms Released

Deadlines The IRS has extended the deadline to furnish the ACA Forms 1095B / 1095C recipient copies from January 31 st, 21 to March 02 nd, 21 Penalties As for Form 1095C, the IRS will not impose a penalty for failure to furnish it in regards to any employee that is enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month ofForm 1095B Filing Instructions An Overview Updated November 05, 800 AM by Admin, ACAwise When the Affordable Care Act (ACA) was passed, the IRS designed Section 6055 of the Internal Revenue Code as a way to gather information on the health insurance coverage that is being offered to individuals · An ALE should furnish an ACA Form 1095C to each of its fulltime employees by March 2, 21, for the calendar year An ALE should file ACA Forms 1094C and 1095C by March 31, 21, if you choose to file electronically, and the Form should file by February 28, 21, if filing on paper Click here to know the State filing deadlines

Affordable Care Act Electronic Filing Instructions

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

· What are the changes to Form 1095C for ? · How do I complete line 16 on the 1095C form?Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part MonthII, includes information

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

Aca Forms

1095C Form Printable 1095C Form Instructions Print 1095C Form Online IRS Form 1095C Fillable Form With Instructions The 1095C Form is a statement of the premium tax credits and costsharing reductions you received in a given year, and is used to reconcile the amount of APTC you're receiving with the amount you were originally entitled to If you're receiving an · The forms and instructions also require employers to include information concerning Individual Coverage Health Reimbursement Arrangements (ICHRAs), if applicable The instructions for Form 1094C state that offers of ICHRA coverage count as offers of minimum essential coverage and both Forms 1095B and 1095C have new codes for informationInstructions for Forms 1094B and 1095B Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement

1094 C 1095 C Software 599 1095 C Software

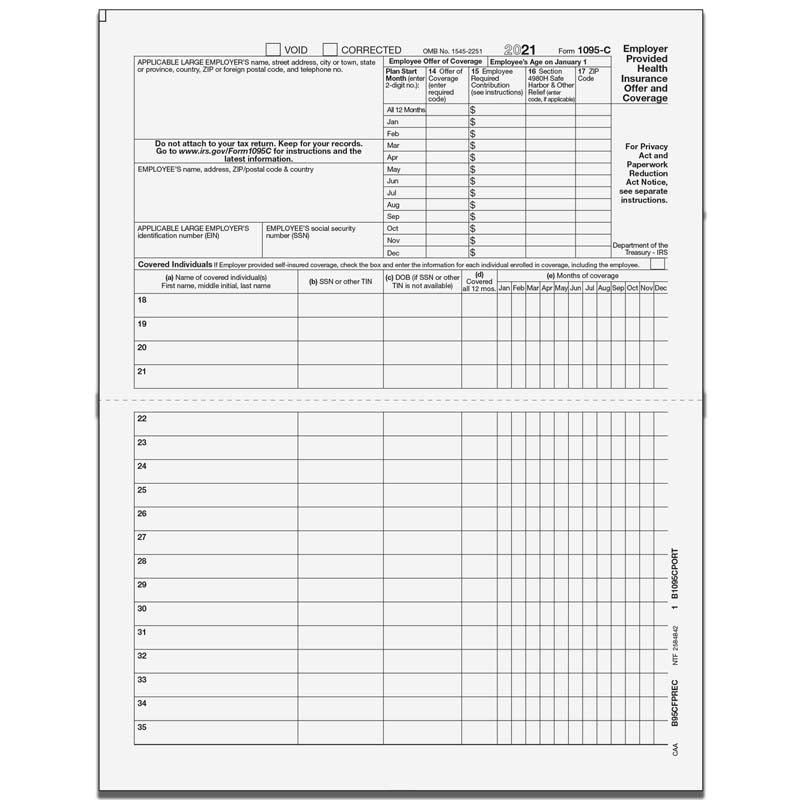

1095 C Preprinted Portrait Version With Instructions On Back

Instructions for Recipient Form 1095C () 6 page 2 In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer's health plan and that plan is a type of plan referred to as a"selfinsured" plan,Form 1095C, Part III, provides information about you and yourOnline solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1094C, steer clear of blunders along with furnish it in a timely manner How to complete any Form 1094C online On the site with all the document, click on Begin immediately along with complete for the editorForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

· Form 1095C On October 15, , the IRS released the final versions of Forms 1094B, 1095B, 1094C, and 1095C, along with final instructions on how to complete the 1094/5B Forms and the 1094/5C Forms · The IRS has released the final instructions for ACA reporting and forms 1094C and 1095C Learn and review the new 1095C codes here2 minute read The IRS has released the final versions of the ACA reporting Forms 1094C and 1095C, in addition to the reporting instructions for the tax year, to

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

Control Files And Sample Forms

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs 1095 Forms And Instructions Fill Pdf Online Download Print Templateroller

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

1095 C Form In Microsoft Dynamics Gp For

Aca Reporting For Individual Coverage Hras

Form 1095 C Forms Human Resources Vanderbilt University

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Changes Coming For 1095 C Form Tango Health Tango Health

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Mailing Deadline February 28 Aca Gps

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

What S New For Tax Year Aca Reporting Air

Irs Final Aca Compliance Forms Now Available Bernieportal

Instructions For Forms 1095 C Taxbandits Youtube

1095 C Form Official Irs Version Discount Tax Forms

trix Irs Forms 1095 C

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Aca 1095 C Code Cheatsheet

1095 C Faqs Office Of The Comptroller

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1094 C 1095 C Software 599 1095 C Software

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Irs 1095 Forms And Instructions Fill Pdf Online Download Print Templateroller

Instructions For Forms 1095 C Taxbandits Youtube

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

Your Monthly Newsletter From Integrated Benefit Solutions Monthly Newsletter By Integrated Benefit Solutions November Final Forms And Instructions For Aca Reporting Released The Internal Revenue Service Irs Released Final Forms And

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Irs Releases Draft Instructions For Forms 1094 C And 1095 C Etc

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

1 0 9 5 C F O R M Zonealarm Results

Sage 100 Contractor U S Aca Forms 1095 C And 1094 C Youtube

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Instructions For Form 1040 Nr Internal Revenue Service

What Your Clients Need To Know About Form 1095 C Accountingweb

Form 1095 A 1095 B 1095 C And Instructions

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Changes Coming For 1095 C Form Tango Health Tango Health

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Employer Aca Reporting Final Forms Lawley Insurance

Compliance Forms 1094 1095 And Instructions

1095 C Employer Provided Health Insurance Offer Of Coverage

Irs Releases Final Forms And Instructions For Aca Reporting Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

Irs Form 1095 C Codes Explained Integrity Data

Irs Extends Deadline For Furnishing Form 1095 C To Employees Woodruff Sawyer

Instructions For Forms 1095 C Taxbandits Youtube

Form 1095 C H R Block

2 0 2 1 1 0 9 5 F O R M Zonealarm Results

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 C Codes Explained Integrity Data

Irs Releases Draft 19 Aca Reporting Forms And Instructions Ingroup Associates

How Do We Report Ichra Coverage On Forms 1094 C And 1095 C

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Forms 1094 C And 1095 C And Reporting Instructions For Irs Issues Final Aca Forms 1094 C 1095 C And Reporting Instructions

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C Instructions For Employers Furnishing Filing

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

1095 C Form 21 Irs Forms

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Instructions For Aca Reporting Released Sequoia

What Payroll Information Prints On Form 1095 C To Employees

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

0 件のコメント:

コメントを投稿