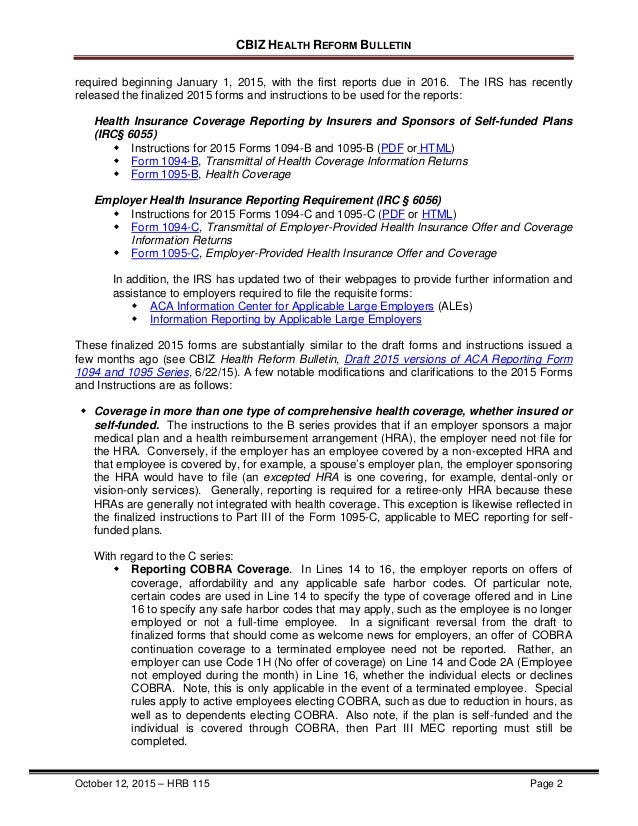

An employee who was in a limited nonassessment period for all 12 months of the year (for example, a new variable hour employee still in an initial measurement period) See the definition of Limited NonAssessment Period in the instructions to Form 1095C for more detailsLine 17 is added in Form 1095C for This line is a new addition to enter the ZIP code used by the employer to determine the affordability This line has to be filled only if the employer is provided with an Individual Coverage HRAs If you have used an employee's primary residence location for calculating affordability, use code 1L, 1MForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

1095 c form definition

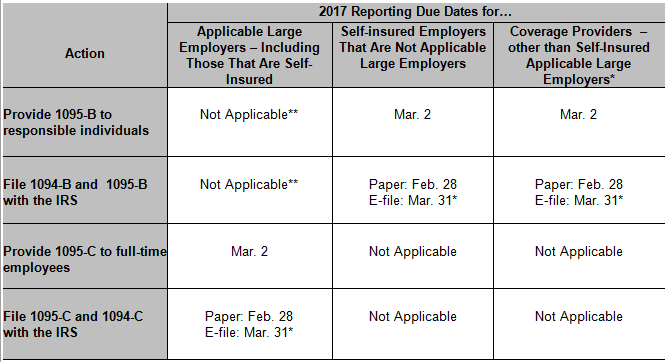

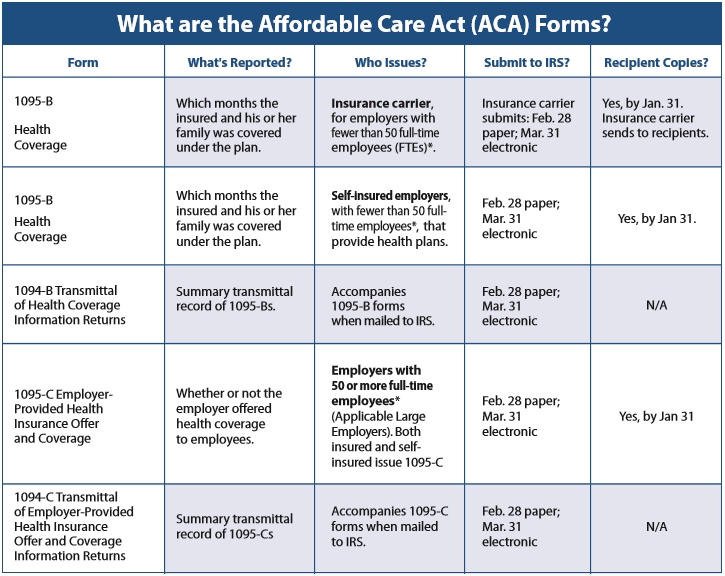

1095 c form definition- The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are Applicable Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

Form 1095 C Guide For Employees Contact Us

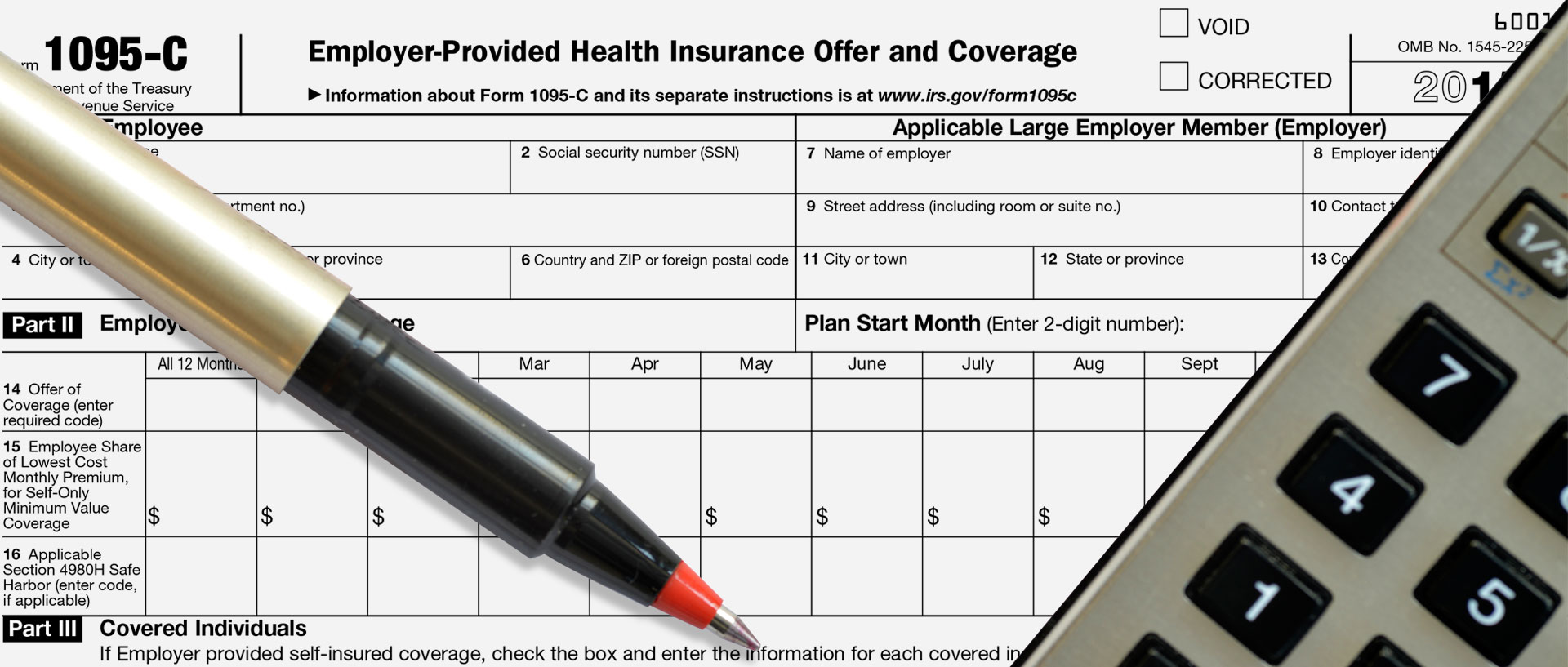

The Affordable Care Act (ACA) requires large employers to report to the IRS on the health coverage, if any, offered to their employees Form 1095C (https//wwwirsgov/uac/AboutForm1095C) provides both you and the IRS information about the health insurance coverage offered to you and, if applicable, your family 2 Form 1095C Form 1095C, employerprovided health insurance offer and coverage, shows the coverage that is offered to you by your employer It is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form provides information of the coverage your employer offered and whether or not you chose to participateWhen information on Part II of a 1095C is conflicting with Part III, selfinsured employers are perplexed about their Affordable Care Act reporting

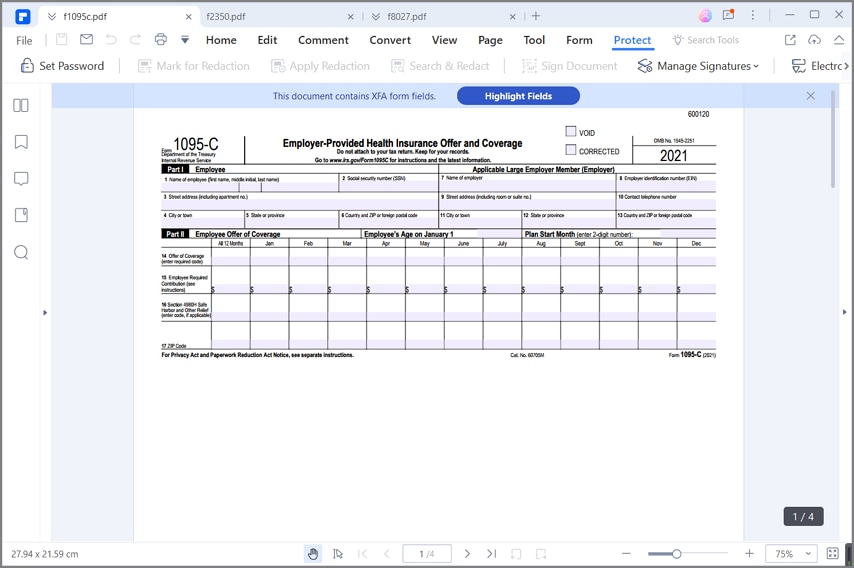

An ALE should furnish an ACA Form 1095C to each of its fulltime employees by , for the calendar year An ALE should file ACA Forms 1094C and 1095C by , if you choose to file electronically, and the Form should file by , if filing on paper Click here to know the State filing deadlinesEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsThe 14 version of the Instructions for Forms 1094C and 1095C ("Instructions") required ALEs that contribute to a multiemployer plan on behalf of fulltime employees ("contributing employers") to obtain information from the multiemployer plan about covered employees

Code 1A alert On , the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095CComplete Forms 1094C and 1095C Form 1094C will be submitted to the IRS and Form 1095C will be submitted to the covered employees The IRS will use this information to decide whether the employer should be subject to penalties and to report on the adequacy and extent of the health insurance coverage availablePrior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

The Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRSAn ALE Member must generally file Form 1094C and Form 1095C on or before February 28 (March 31 if filed electronically) of the year immediately following the calendar year for which the offer of coverage information is reportedBelow is a helpful list of ACAspecific terms and definitions for gaining a better understanding on the rules It is the Form 1094C that contains all aggregated ALE Group information Unit must ensure that among the multiple Forms 1094C filed by or on behalf of the Governmental Unit transmitting Forms 1095C for the Governmental Unit

2

2

To sum it up, preparing the Form 1095C entails the understanding of the intricate requirements, definitions, formulas, and reporting codes of the provisions The process can involve payroll vendors to determine an employee's fulltime status and affordability of coverage, as well as benefits or human resources departments for identifying Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes a payment under the Employer Shared Responsibility Provisions under IRC Section 4980H Generally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance MarketplaceDoes not need to entered in Turbotax 1095C forms are filed by large employersIf they are selffunded, they just fill out all sections of 1095C

What Is A 1095 C Erp Software Blog

Http Lambbarnosky Com Wp Content Uploads 15 12 Client Memo Attachment Aca Pdf

Form 1095C EmployerProvided Health Insurance Offer and Coverage is an Internal Revenue Service (IRS) tax form reporting information about an employee's health coverage offered by1 What is a 1095C? You may get Form 1095B or 1095C in the mail Do not enter these in TurboTax Some products, that help pay for medical services don't qualify If you have only this kind of product, you may have to pay the fee Examples include Coverage only for vision care or dental care;

Irs Tax Forms Wikipedia

Code Series 2 For Form 1095 C Line 16

The first reporting requirement for ALEs is to provide a copy of Form 1095C to every fulltime employee, regardless of whether they enrolled in the companysponsored health plan Employers must also keep a copy of every 1095C form to send to the IRS to fulfill ACA reporting requirements for 19(Form 1095C, Line 14) CODE SERIES 1 Offer of Coverage 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with Employee Required Contribution equal to or less than 95% (as adjusted) of mainland single federal poverty line and at least minimum essentialIn these situations, a Form 1095B is to be generated for all covered individuals regardless of employment status 1095C Form 1095C provides evidence that an ALE offered, or did not offer, affordable MEC to all fulltime employees In other words, it documents whether an ALE met the employer shared responsibility requirements

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your homeForm 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to report the canceled debt on his or herReview the available codes and definitions for Lines 14 and 16 of Form 1095C• Form 1095C Code Cheat Sheet • Form Instructions (Page 11) Consider grouping employees by code "profile" and starting with the easiest ones first • Form 1095C Code Cheat Sheet

What Is A 1095 C Erp Software Blog

1

Form 1095C is used to report information about each employee The information reported on Form 1094C and Form 1095C is used in determining whether an employer is potentially liable for a payment under the employer shared responsibility provisions of section 4980H, and the amount of the payment, if anyForm 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees inTax Form 1095C is a document that contains detailed information about health care coverage offered to applicable employees The ACA has mandated that employers provide Tax Form 1095C to all eligible employees as of 16 (for tax year 15) Tax Form 1095C serves as proof of insurance, and is formal documentation of ACA compliance for the IRS

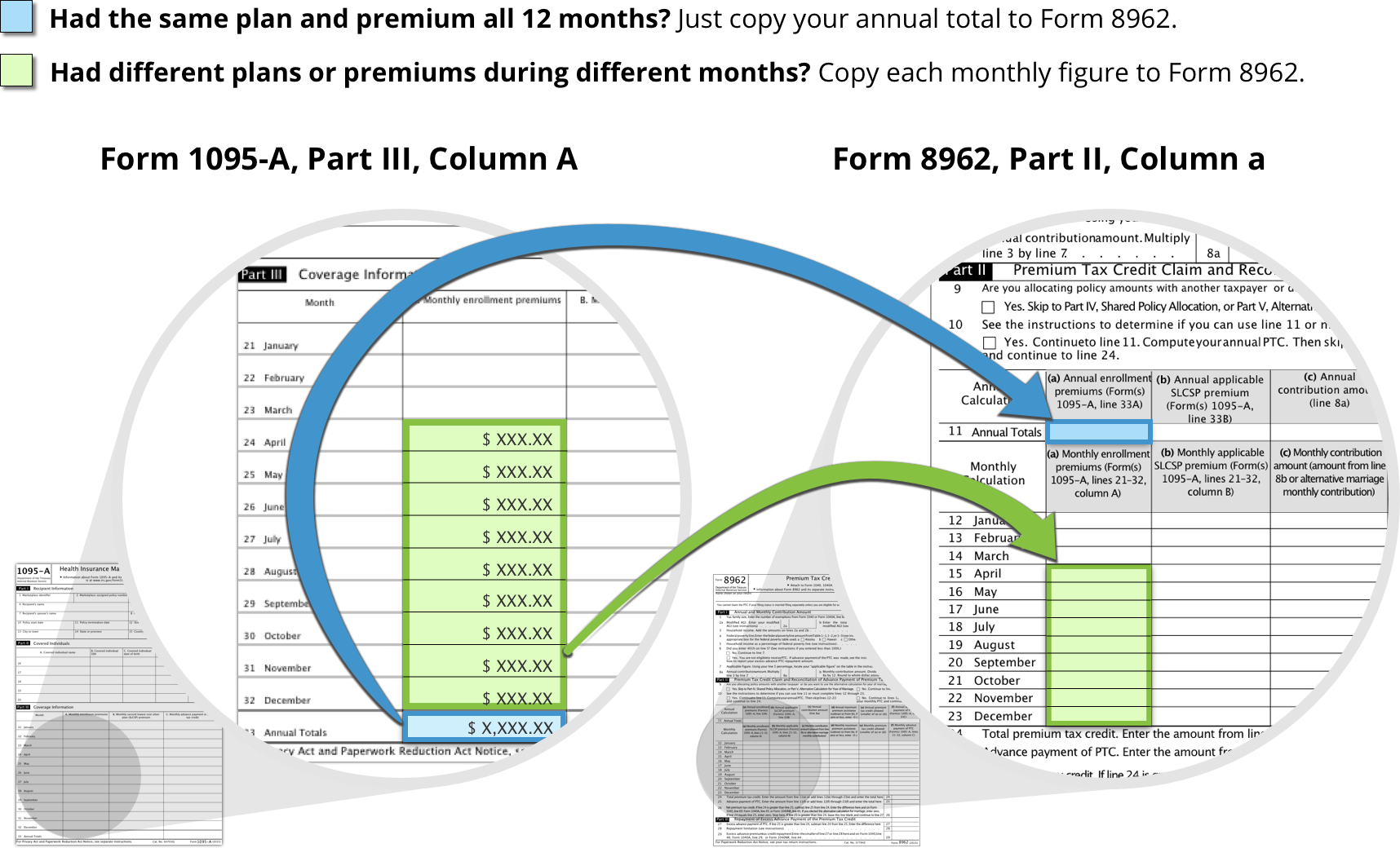

How To Reconcile Your Premium Tax Credit Healthcare Gov

2

IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season What is Form 1095C EmployerProvided Health Insurance Offer and Coverage Updated for Tax Year / 0435 AM OVERVIEW The Affordable Care Act, or Obamacare, requires certain employers to offer health insurance coverage to fulltime employees and their dependentsForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland

What Is The Irs 1095 C Form Miami University

Changes Coming For 1095 C Form Tango Health Tango Health

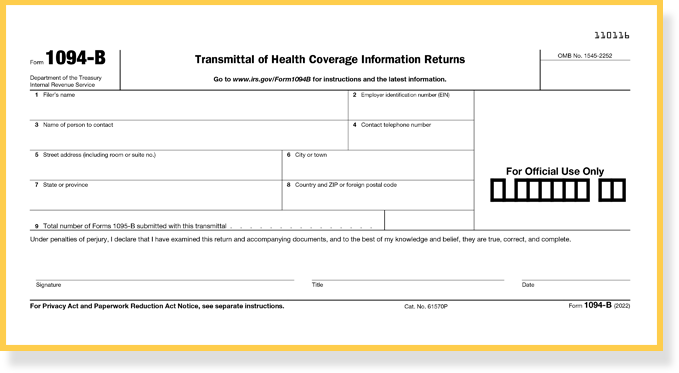

Form 1095C contains information about the offer of health insurance coverage to employees and their dependents, the employee's share of the lowestcost premium, and other information related to employer responsibility provisions Information on this form is required to prepare and file your annual tax return OVERVIEW IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CTIPEmployers are required to furnish Form 1095Conly to the employee As the recipient of this Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Www Irs Gov Pub Irs Utl Ty18 1095 C crosswalk Pdf

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

IRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single It comes from the Marketplace and shows both you and the IRS what you paid outofpocket for your insurance premiums If you have health insurance from a private insurer outside of the Marketplace or that you receive from an employer, your coverage will be reported to the IRS on Form 1095B (for coverage from other insurers) or Form 1095C (for employersponsoredForm 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form is used by the employee to report the healthcare coverage offered to them by his or her employer 9

Sandiegounified Org Userfiles Servers Server File Departments Benefits Affordable care act District faq for web 1095 C and 1095 B Updated Tax year 19 Pdf

Irs 1095 C Form Pdffiller

ACA Form 1095C Codes Sheet An Overview Updated 800 AM by Admin, ACAwise The IRS requires ALEs to report their employee's health coverage information on Form 1095C To report the information, ALEs must be clear about the Offer of Coverage and Safe Harbor Codes that should be entered on the ACA Form 1095CThe IRS Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining

Form 1095 C Instructions Line By Line 1095 C Instruction Explained

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

2

Understanding Irs Forms 1095 A 1095 B And 1095 C

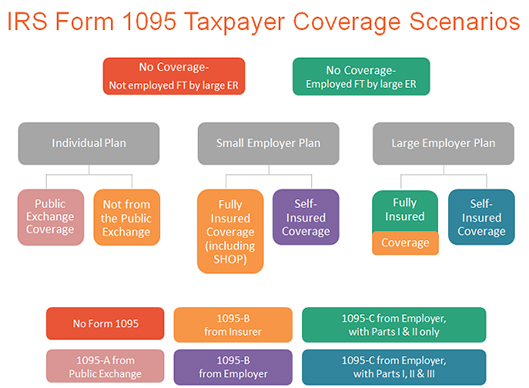

Health Reform Bulletin Oct 15 Amendments To The Small Employer D

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Edit An Aca Status

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Www Fscj Edu Docs Default Source Hr Misc Form 1095 C Faqs9bcdeeaff0000e316a3 Pdf Sfvrsn 6a2987d5 4

Www Irs Gov Pub Irs Prior Ic 15 Pdf

1

The Codes On Form 1095 C Explained The Aca Times

1095 C Form Official Irs Version Discount Tax Forms

16 Aca Reporting Forms And Instructions Revisions To Draft Forms 1094 C And 1095 C Eastern Insurance

Aca Alerts The Benefit Companies

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

2

Updates To Form 1095 C For Filing In 21 Youtube

1

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1095 C Employer Provided Health Insurance Offer And Coverage Editorial Image Image Of Federal Coverage

Http Www Une Edu Pdfs Faq Aca 1095 C

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Irs Reporting Tip 2 Form 1095 C Line 14 Code 1a Versus 1e And When To Use 1i Innovative Benefit Planning

Www Ftb Ca Gov File Business Report Mec Info Ftb File Exchange System 1094 1095 Technical Specifications Part 1 Pdf

What Are The Differences Between Form 1095 A 1095 B And 1095 C

Irs Form 1095 C Fauquier County Va

2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Sample 1095 C Forms Aca Track Support

Aca Code Cheatsheet

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

2

Www Fullerton Edu Asc Hr Documents2 Benefits 1095taxform Pdf

November 15 Issue By Cynthia Thompson Issuu

1095 C Reporting Determining A Company S Ale Status Integrity Data

Form 1095 C Guide For Employees Contact Us

Employer Reporting Of Health Coverage Presented By Carly

Hr Updates Theu

Employer Reporting Of Health Coverage Presented By Carly

What Is The Irs 1095 C Form Miami University

1095 C Print Mail s

Free 1095 C Resource Employee Faqs Yarber Creative

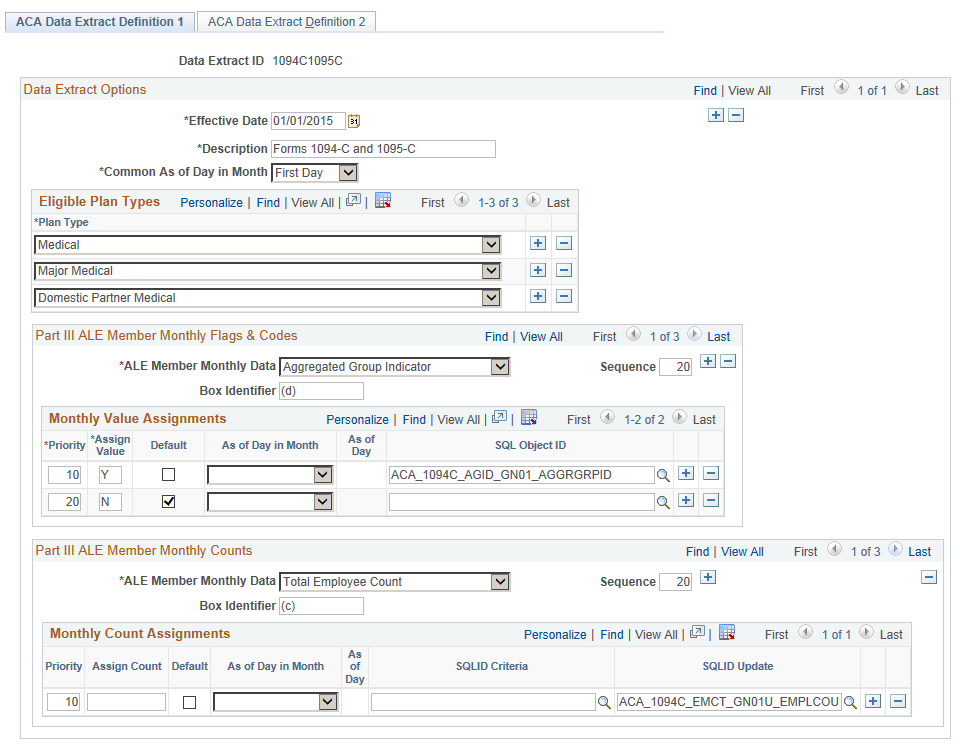

Setting Up And Managing Data Extraction For Forms 1094 C And 1095 C

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/88305472-ACA-reporting-56a0a45f5f9b58eba4b25f4a.jpg)

Health Care Law Reporting Requirements For Employers

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1095 C Electronic Consent News Illinois State

1

Questions Answered For Mastering The 1095 C Form Blog Tango Health

What The Heck Is Form 1095 C

Parking Magazine August 16

What Is An Irs Form 1095 C Boomtax

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Form Official Irs Version Discount Tax Forms

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Tax Form 1095 A Frequently Asked Questions

Changes In Irs Form 1095 C For Taxbandits Youtube

Form 1095 C How To Discuss

Your 1095 C Tax Form My Com

Aca Compliance Bulletin Final Form For Aca Reporting

Www Calpers Ca Gov Docs Circular Letters 15 600 064 15 Attach1 Pdf

Www Irs Gov Pub Irs Schema 1095c Ty15 Cw Pdf

Www Houstonisd Org Cms Lib2 Tx Centricity Domain Hisd 17 1095c Faqs Pdf

Sample 1095 C Forms Aca Track Support

Form 1095 B How To Discuss

Http Cdn2 Hubspot Net Hubfs 1094 Simplified Pdf

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Irs Form 1095 C To Be Distributed Hub

Ez1095 Software How To Print Form 1095 C And 1094 C

Guide To Form 1095 H R Block

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Www Whoi Edu Fileserver Do Id Pt 2 P 769

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

What Is A 1095 C Form Do I Have To File It With Taxes Al Com

Mn Gov Mmb Stat Segip Doc 1095 C Faq Pdf

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

0 件のコメント:

コメントを投稿